The following is a detailed guide on how to appoint director for a Company, representative and employer’s representative in the Mytax portal. The Mytax portal can be accessed via this link.

Appointment as director for a Company

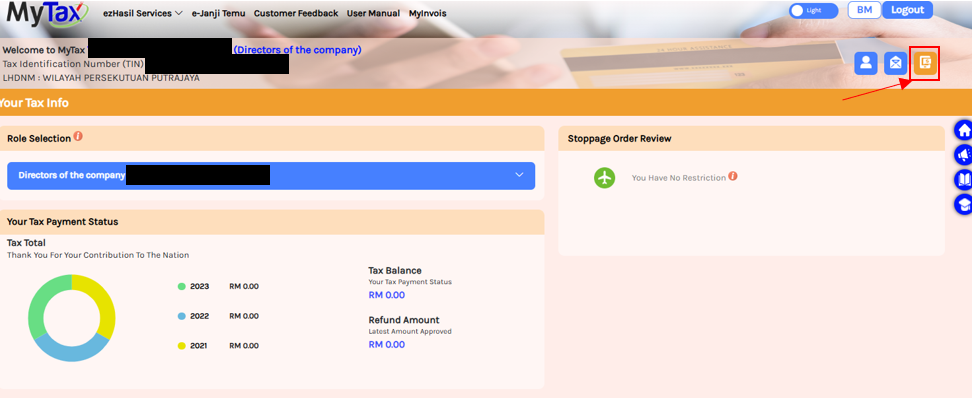

Step 1: Log in to the Mytax portal and select the human icon

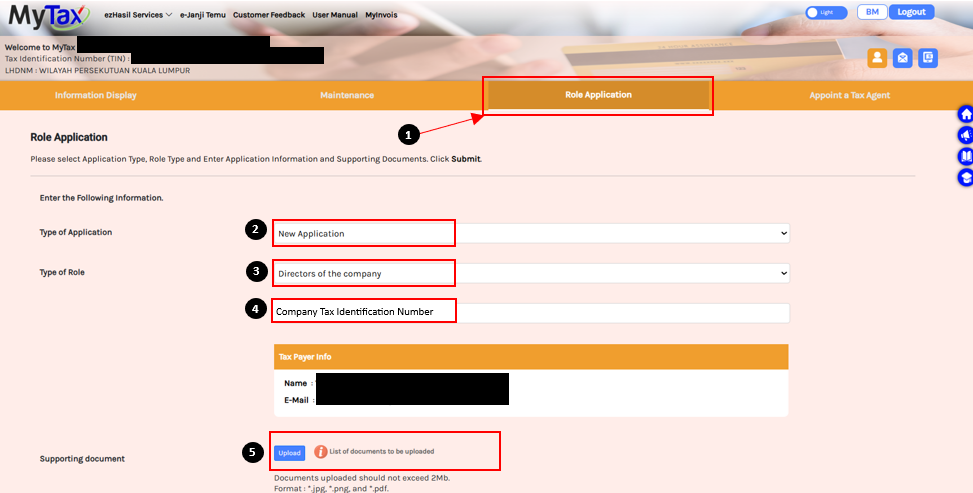

Step 2: Please follow the following steps:

(1) Select role application

(2) Select new application

(3) Select Directors of the Company (Select “Business Owner” if it is sole proprietor / partnership)

(4) Insert Company’s Tax Identification Number

(5) Upload supporting documents to support individual as director of the Company e.g. Company Incorporation Certification (Form 9) and Company’s Directors Information (Superform / Form 49).

The approval process will take approximately 5 days once submitted successfully.

Once successful, the director / business owner is required to log in to their personal MyTax portal again to appoint representative or employer’s representative. Please note that both functions are different.

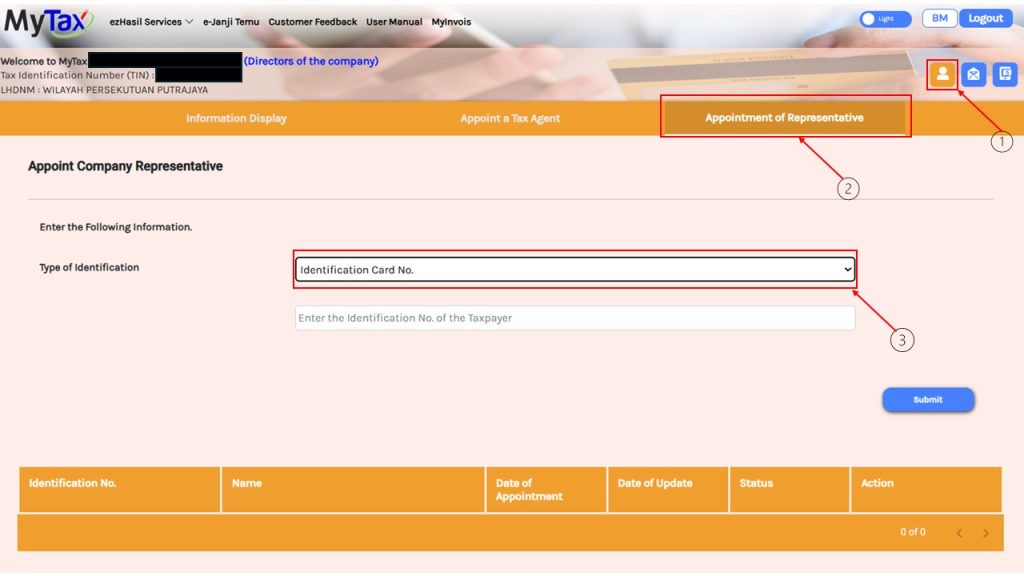

Appointment of representative

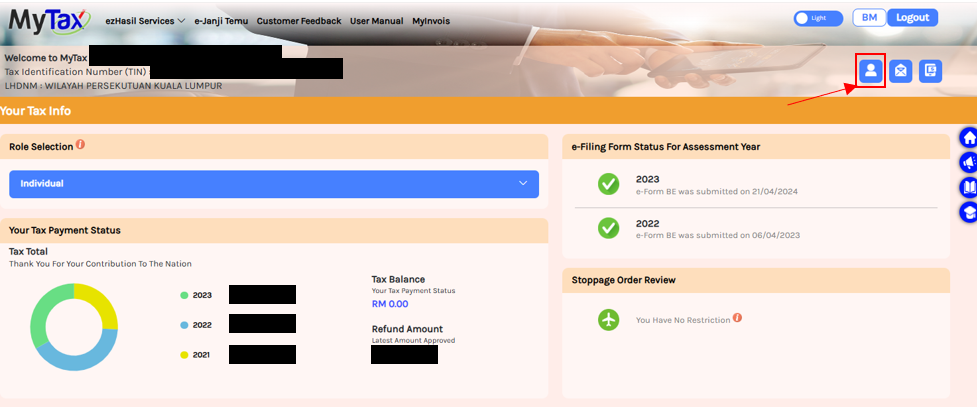

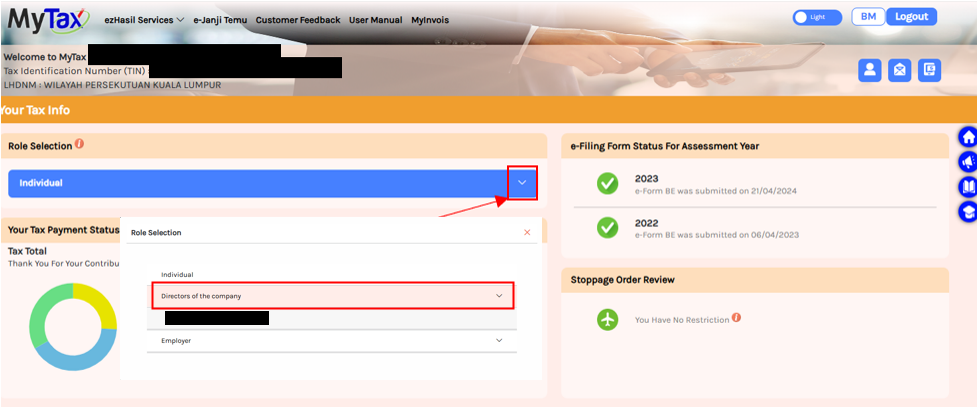

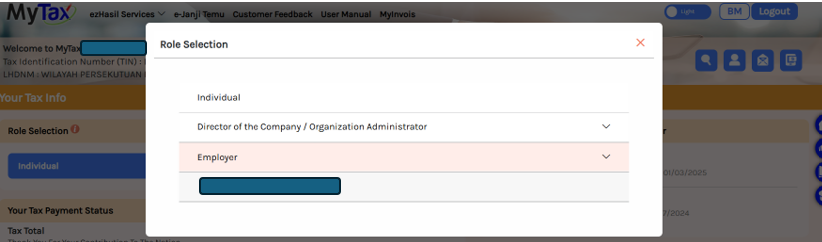

Step 1: Director to login and select the dropdown box. Select the role as director of the Company

Step 2: Select the human icon. Select “Appointment of Representative”. Enter Identification Card (IC) number and click submit.

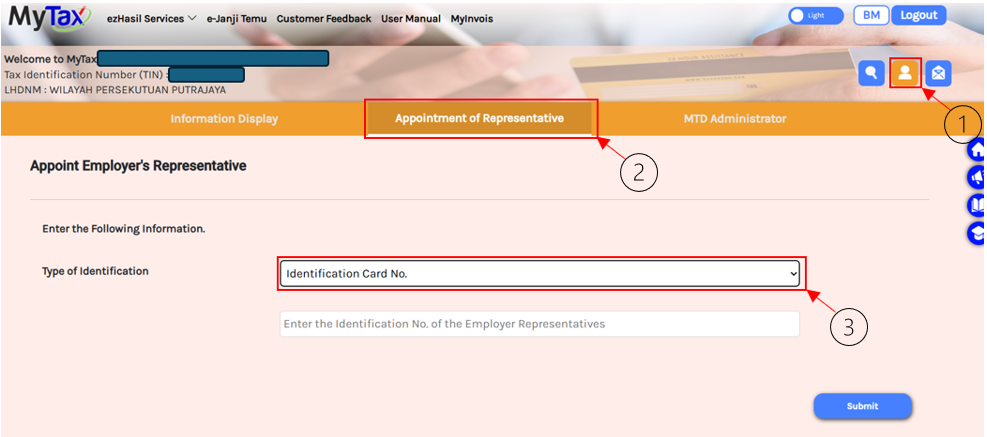

Appointment of employer’s representative

Step 1: Director to login and select the dropdown box. Select the role as Employer of the Company

Step 2: Select the human icon. Select “Appointment of Representative”. Enter Identification Card (IC) number and click submit.

Accessing Company tax details

Select the Mytax Status Icon to access the Company’s ledger, tax estimation, annual tax return etc